“No man needs a vacation so much as the man who has just had one.” –Elbert Hubbard

Apparently, it was Skeleton Crew Fridays every day during the month of August. A tag-team caravan of people coming back from vacations as others headed out, making August a month defined by a lack of activity rather than notable doings. That meant new issuance, especially in corporates, with the bulk of that limited issuance in the primary market being concentrated in investment grade credits. High yield issuers waited on the sidelines anticipating a more welcoming market once everyone resumed their posts after Labor Day. In fact, for high yield, the most newsworthy thing is just who was waiting in the wings. This left the high yield market in the position of not spending too much time discussing what is happening today versus trying to get excited about next month’s issuance lineup. The only other market with a small smattering of deals was ABS, but even that was limited to a few auto deals and the odd consumer loan deal. Most of what one sees is just a lot of sell-side desks manned by juniors who seem less than eager to trade for fear of making a mistake, and a lot of buy side desks not trusting market movements due to how shallow the markets are. In other words, everyone seems to simply prefer to wait for the month to end.

Rather than discussing what August hasn’t been, what we can do is think of the month as simply a pause before we move into some of the busier months of the year, and a springboard to how the year will finish. The next few months should be crowded not only with new issuance, especially notable deals postponed but needed for financing in the high yield sector, but the expected and scheduled deals in ABS and investment grade corporates. So, here are three things we are focused on for the next few months and where we think opportunities may await and where worries might reside:

Rates

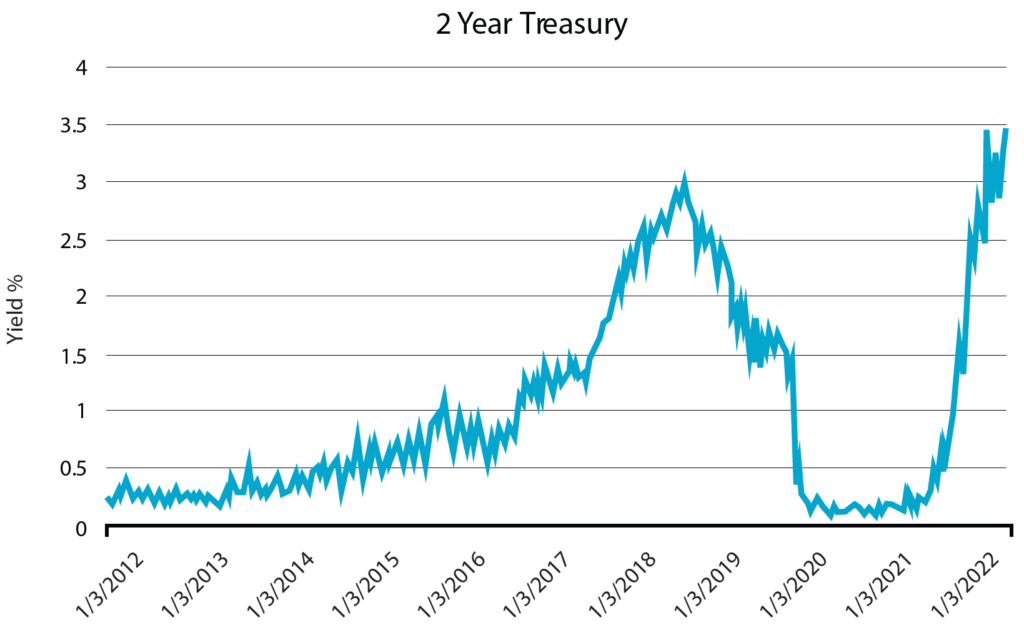

One of the most obvious, but more specifically the 2-year treasury. This part of the curve has taken the brunt of volatility in rates. It’s been a dramatic sell-off for sure for the past year, filled with concern the curve inverted, followed by acceptance of the inversion, wrapped around market participants embracing the daily dance of whether to be more concerned about inflation or recession. Even with a relatively dormant month, a few notable things occurred during August which seemed to spark a smaller but notably further sell-off in treasuries. One of those was of course Jackson Hole, where Powell and the Powell-ites held court, emphasizing their hawk-like message of “whatever it’s gonna take, we are gonna do”. Additionally, anecdotally there were several news articles and headlines around large hedge fund trades involving the 2-year. The trades themselves, boosted with added headline fuel, seemed to push the market even harder than Powell. As we mentioned, given the calendar and the more limited staff manning the desks, this resulted in a more shallow investment trading arena getting pushed around by the oversized trades and seemingly accomplishing the goal of pushing yields higher.

Yields on the 2-year are now at levels not seen in a decade, further illustrating not only how low rates have been for over a decade of time in the markets, which seemingly had gotten used to feasting on those low rates, but also just how fast that reversed in an even more limited 1-year amount of time.

Nevertheless, we do seem to be nearing the end. Prior to this month, when new issuance had occurred, we seemed to be seeing less demand for floating rate securities not only in the primary issuance market, where deals that were announced as having a variable rate tranche dropped that tranche due to lack of interest, and less activity in the secondary market. We have also seen small signs of slowing growth and waning inflation. Earnings remain strong on an overall basis, but a few notable misses have occurred. We see a red-hot job market starting to cool ever so much. We see the price of gasoline per gallon falling such that at peak driving season, August, we are now well below levels seen in the spring and a national average well below $4.00. We are seeing signs of shipping costs falling to 6-month lows. And we see no signs of shortages in stores, indicating, that the supply chain has untangled itself some. We still await the next set of numbers to confirm that waning inflation, but with signs that seem to indicate that, and perhaps a too aggressive FOMC, we do feel rate pressure should ease. As such, we look forward to a yield curve morphing such that inversion fades and a more normal curve begins to take shape. We still have plenty of time for that to occur, it certainly isn’t going to happen overnight, but we do expect as those things occur, for it to be identifiable in the 2-year.

We attempt to stay as neutral to rates as possible, but if the yield curve reverts to a more normal steepness, then it would signify a significant rally in rates. As such, positioning oneself in solid names in that area of the curve should represent some opportunities for over-performance in the near and longer-term.

Credit Spreads

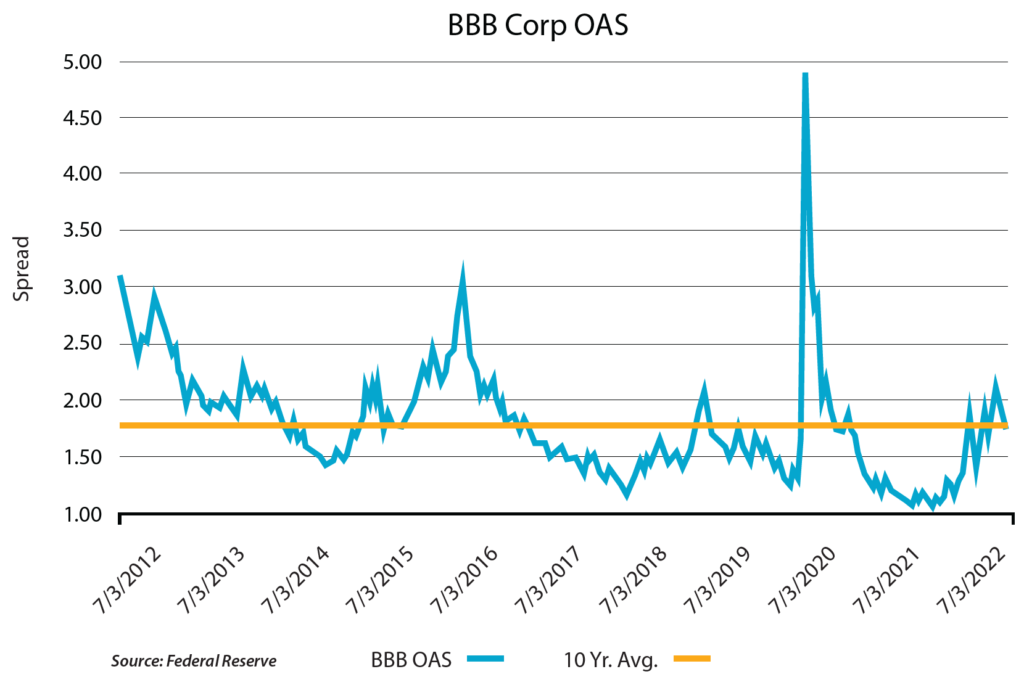

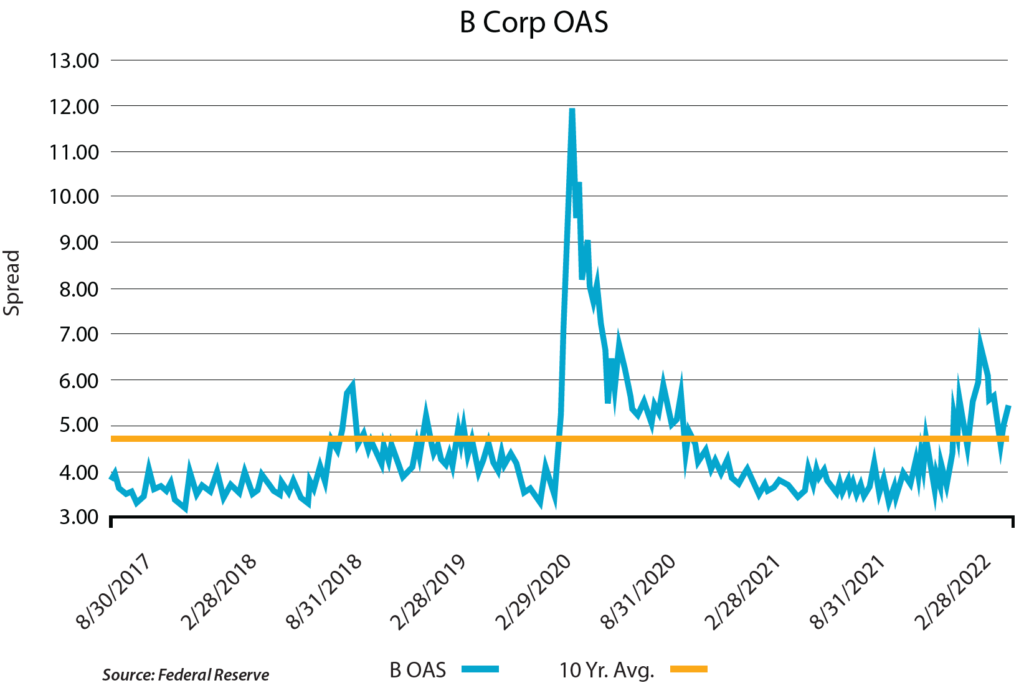

Not all of them. Just some of them. Corporate investment grade and high yield OAS have reverted somewhat such that they are now around the 10-year averages, respectively, as illustrated below. And while we do expect if we see a cooling in the economy there will be some compression of spreads in investment grade and a widening out in high yield, and thus some upside in investment grade to be found, there is bigger upside to be had away from corporates.

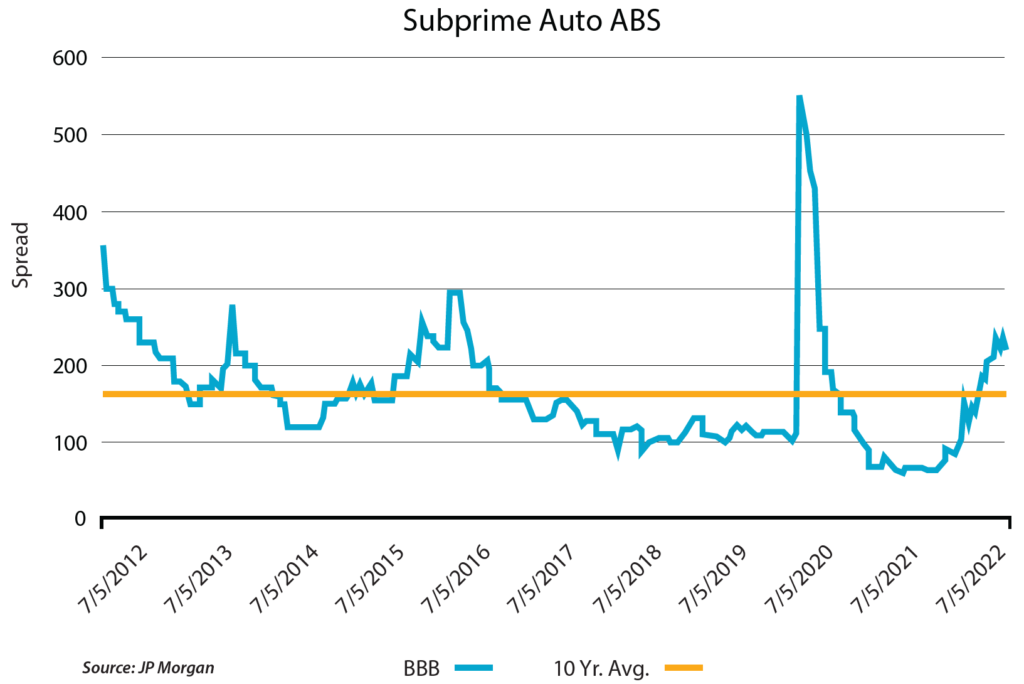

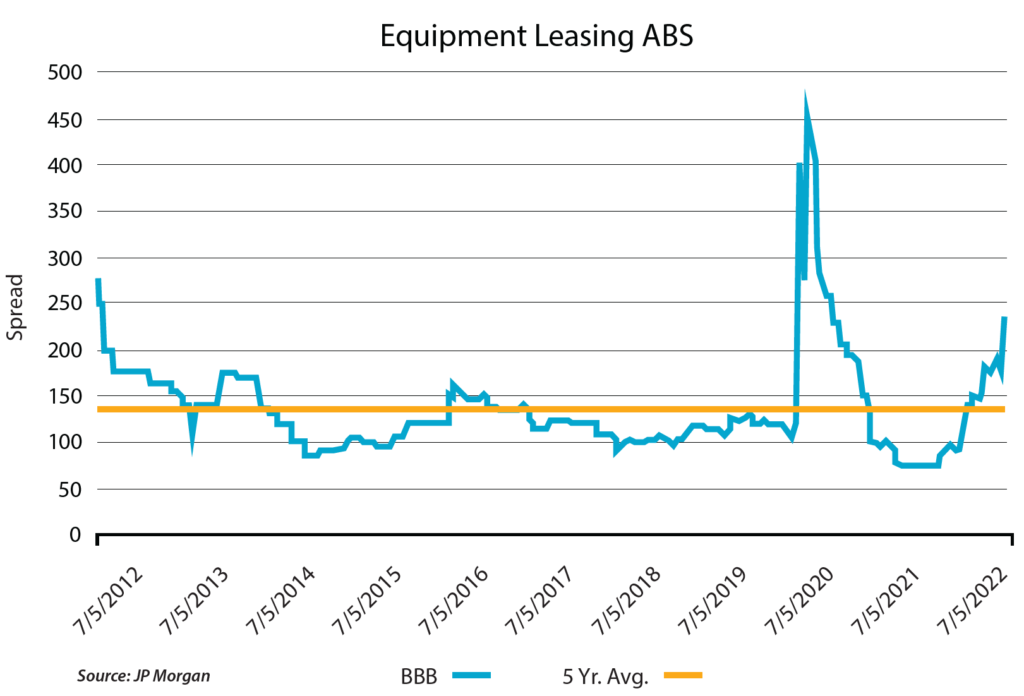

That upside seems to be available in ABS. Below are two charts illustrating how spreads have widened out in some of the more heavily trafficked areas of securitization: subprime auto ABS and equipment leasing ABS. As can be seen, spreads have pushed out well above 10-year averages, indicating they are safely hovering in an area one would classify as cheap. As such, we would expect in the near term that once we all return from the Labor Day hiatus, more activity will be met by solid demand. We would also expect spreads to compress and produce possible over-performance. We have already seen evidence of that, as the most recent deals have been oversubscribed in a healthy manner, indicating investors have cash ready to deploy and seem eager to take advantage of the current wider spreads. Additionally, we are aware of a number of deals ready to be launched once September rolls around. We think Issuers will carry that need into the fourth quarter, especially early in the fourth, to lock in funding prior to the holidays.

Furthermore, if the economy were to cool to the point of recession, we favor being secured to unsecured with the added credit enhancement of these deals further strengthening and protecting us from downside credit risk. This all translates into being positioned more conservatively while at the same time being able to feast initially on wider spreads and in the near term, benefiting from spread compression that should lead to over-performance. We have found even better value of late in secondary pieces, which not only provide the prior mentioned credit protection and near-term upside, but also mean we are able to have the benefit of seasoning and in many cases multiple months of performance to analyze to get even greater comfort.

Flows

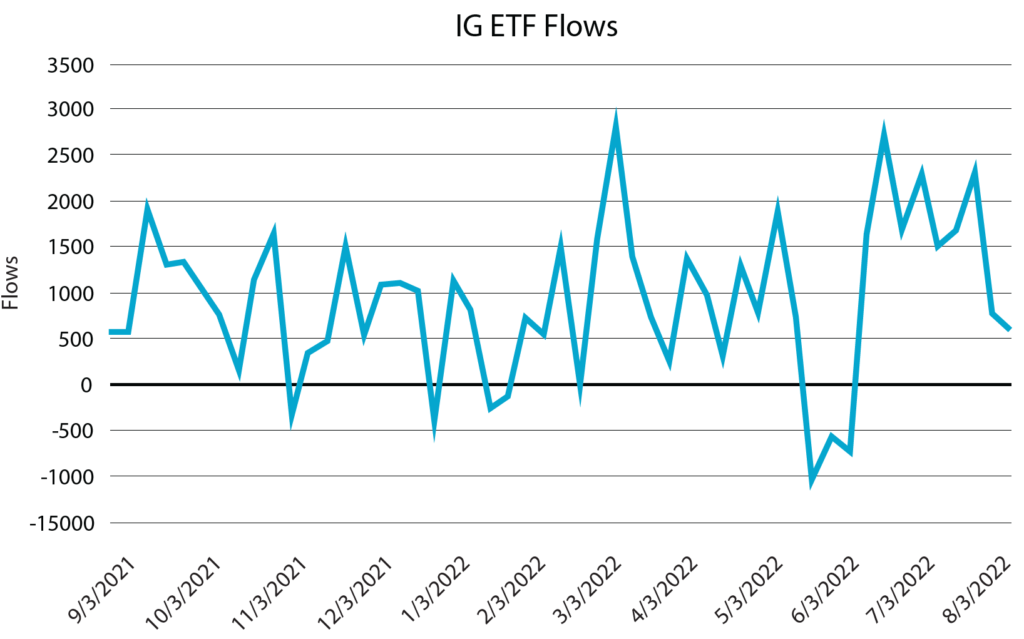

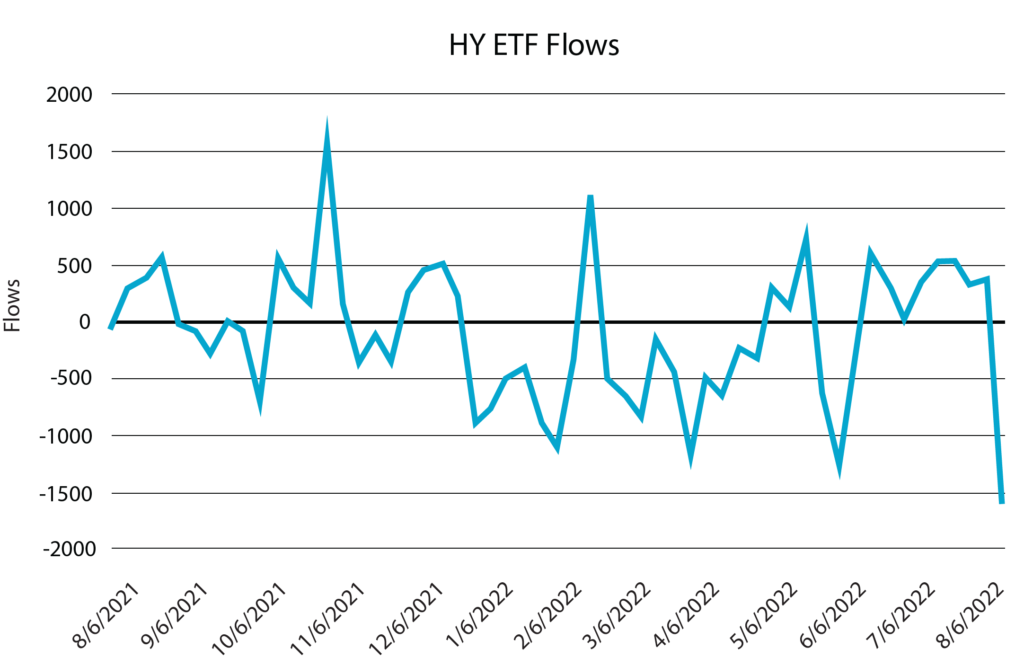

The last thing worthy of mentioning is in the area of flows. More specifically, bond ETF flows. Flows in the space can be and have been of late volatile. That isn’t necessarily news. However, what is typically glossed over is just how influential the flows can be when it comes to market activity (especially when it comes to the secondary markets). When there are massive outflows in the space, we see the market littered with bid wanted lists as ETFs put out to bid numerous lists of securities. This flooding of the market with a need to sell can obviously overwhelm normal volumes and cause big movements in spreads and thus, pricing. There are certainly days when we see heavy inflows that in turn can cause spread tightening. However, as fixed income market players will tell you, they are always more worried about liquidations which can result in sizable negative price movements which ultimately can cause contagion risk in the markets. Thus, flows of these behemoths are always worth paying attention to.

Of late, investment grade bond ETF flows have stabilized, and although there have been weeks where the flows have dropped off, we haven’t seen negative flows since June. High yield on the other hand still seems to be in a negative flow situation, which (especially given the area of credit those funds invest in) causes a multiple level of widening in spreads as forced sells are occurring.

This type of flow movement is something worth paying attention to. It can prove to be opportunistic, waiting for a good entry point into the market when flows can help push sells and a need for liquidity arises. On the other hand, it is also instrumental as we keep in mind the possibility of a slowdown in the fourth quarter, market action that causes flows to keep in a negative trend in ETFs and the possibility of further spread widening in exposures below investment grade. Thus, flows can serve as a canary in the coal mine for movements in fixed income spreads and liquidity.

August can be, and has been, an odd moment in the calendar historically. The slow days, lightly populated desks and shallow trading can lead to ripe conditions for volatility. But ignoring the noise, August is more an opportunity to seek out and plan for how the year will close. Rates, credit spreads and flows are a few areas of focus as we contemplate sectors and conditions that might help us capture momentum and over-performance into yearend. We do expect opportunities for over-performance will be available and thus expect to position ourselves in a manner to take advantage of those moments. In many cases it is possible that the upside won’t be obvious in the short term but over time we expect these types of opportunities to help build a solid foundation for future over-performance in the near and long term.

Definition of Terms

Basis Points (bps) – refers to a common unit of measure for interest rates and other percentages in finance. One basis point is equal to 1/100th of 1%, or 0.01%, or 0.0001, and is used to denote the percentage change in a financial instrument.

Curvature – A yield curve is a line that plots yields (interest rates) of bonds having equal credit quality but differing maturity dates. The slope of the yield curve gives an idea of future interest rate changes and economic activity.

Mortgage-Backed Security (MBS) – A mortgage-backed security is an investment similar to a bond that is made up of a bundle of home loans bought from the banks that issued them.

Collateralized Loan Obligation (CLO) – A collateralized loan obligation is a single security backed by a pool of debt.

Commercial Real Estate Loan (CRE) – A mortgage secured by a lien on commercial property as opposed to residential property.

CRE CLO – The underlying assets of a CRE CLO are short-term floating rate loans collateralized by transitional properties.

Asset-Backed Security (ABS) – An asset-backed security is an investment security—a bond or note—which is collateralized by a pool of assets, such as loans, leases, credit card debt, royalties, or receivables.

Option-Adjusted Spread (OAS) – The measurement of the spread of a fixed-income security rate and the risk-free rate of return, which is then adjusted to take into account an embedded option.

Enhanced Equipment Trust Certificate (EETC) – One form of equipment trust certificate that is issued and managed through special purpose vehicles known as pass-through trusts. These special purpose vehicles (SPEs) allow borrowers to aggregate multiple equipment purchases into one debt security

Real Estate Investment Trust (REIT) – A company that owns, operates, or finances income-generating real estate. Modeled after mutual funds, REITs pool the capital of numerous investors.

London InterBank Offered Rate (LIBOR) – a benchmark interest rate at which major global banks lend to one another in the international interbank market for short-term loans.

Secured Overnight Financing Rate (SOFR) – a benchmark interest rate for dollar-denominated derivatives and loans that is replacing the London interbank offered rate (LIBOR).

Delta – the ratio that compares the change in the price of an asset, usually marketable securities, to the corresponding change in the price of its derivative.

Commercial Mortgage-Backed Security (CMBS) – fixed-income investment products that are backed by mortgages on commercial properties rather than residential real estate.

Floating-Rate Note (FRN) – a bond with a variable interest rate that allows investors to benefit from rising interest rates.

Consumer Price Index (CPI) – a measure that examines the weighted average of prices of a basket of consumer goods and services, such as transportation, food, and medical care. It is calculated by taking price changes for each item in the predetermined basket of goods and averaging them.

Net Asset Value (NAV) – represents the net value of an entity and is calculated as the total value of the entity’s assets minus the total value of its liabilities.

S&P 500 – The Standard and Poor’s 500, or simply the S&P 500, is a stock market index tracking the stock performance of 500 large companies listed on exchanges in the United States.

German DAX – The DAX—also known as the Deutscher Aktien Index or the GER40—is a stock index that represents 40 of the largest and most liquid German companies that trade on the Frankfurt Exchange. The prices used to calculate the DAX Index come through Xetra, an electronic trading system.

NASDAQ – The Nasdaq Stock Market (National Association of Securities Dealers Automated Quotations Stock Market) is an American stock exchange based in New York City. It is ranked second on the list of stock exchanges by market capitalization of shares traded, behind the New York Stock Exchange.

MSCI EM Index – The MSCI Emerging Markets Index captures large and mid cap representation across 24 Emerging Markets (EM) countries. With 1,382 constituents, the index covers approximately 85% of the free float-adjusted market capitalization in each country.

Nikkei – The Nikkei is short for Japan’s Nikkei 225 Stock Average, the leading and most-respected index of Japanese stocks. It is a price-weighted index composed of Japan’s top 225 blue-chip companies traded on the Tokyo Stock Exchange.

Shanghai Composite – is a stock market index of all stocks (A shares and B shares) that are traded at the Shanghai Stock Exchange.

MOVE Index – The ICE BofA MOVE Index (MOVE) measures Treasury rate volatility through options pricing.

VIX Index – The Cboe Volatility Index (VIX) is a real-time index that represents the market’s expectations for the relative strength of near-term price changes of the S&P 500 Index (SPX).

Dow Jones Industrial Average – The Dow Jones Industrial Average is a price-weighted average of 30 blue-chip stocks that are generally the leaders in their industry.

Hang Seng – The Hang Seng Index is a free-float capitalization-weighted index of a selection of companies from the Stock Exchange of Hong Kong.

STOXX Europe 600 – The STOXX Europe 600, also called STOXX 600, SXXP, is a stock index of European stocks designed by STOXX Ltd. This index has a fixed number of 600 components representing large, mid and small capitalization companies among 17 European countries, covering approximately 90% of the free-float market capitalization of the European stock market (not limited to the Eurozone).

Euro STOXX 50 – The EURO STOXX 50 Index is a market capitalization weighted stock index of 50 large, blue-chip European companies operating within eurozone nations.

CAC (France) – is a benchmark French stock market index. The index represents a capitalization-weighted measure of the 40 most significant stocks among the 100 largest market caps on the Euronext Paris (formerly the Paris Bourse).

Duration Risk – the name economists give to the risk associated with the sensitivity of a bond’s price to a one percent change in interest rates.

Federal Open Market Committee (FOMC) – the branch of the Federal Reserve System (FRS) that determines the direction of monetary policy specifically by directing open market operations (OMO).

United States Treasury (UST) – the national treasury of the federal government of the United States where it serves as an executive department. The Treasury manages all of the money coming into the government and paid out by it.

High Yield (HY) – high-yield bonds (also called junk bonds) are bonds that pay higher interest rates because they have lower credit ratings than investment-grade bonds. High-yield bonds are more likely to default, so they must pay a higher yield than investment-grade bonds to compensate investors.

Investment Grade (IG) – an investment grade is a rating that signifies that a municipal or corporate bond presents a relatively low risk of default.

Exchange Traded Fund (ETF) – an exchange traded fund (ETF) is a type of security that tracks an index, sector, commodity, or other asset, but which can be purchased or sold on a stock exchange the same as a regular stock.

Federal Family Education Loan Program (FFELP) – a program that worked with private lenders to provide education loans guaranteed by the federal government.

Business Development Program (BDC) – an organization that invests in small- and medium-sized companies as well as distressed companies.

Control #: 15622192-UFD-9/13/2022